Ireland Online Gambling Tax

Ireland is set to introduce new legislation that will raise €25 million in gambling taxation from foreign operators.

In 2001, Irish residents were allowed to gamble online. Finally, in 2013, gambling was totally legalised, so nowadays, Irish players can freely play in Ireland and on foreign websites. Both local and international operators can also organise legal licensed businesses in Ireland. Forms of gambling activities include online casinos, lotteries.

- Online casino Ireland. That’s why Ireland is referred to as a tax haven. After impressive growth numbers, 7 percent between 2001 and 2004, and 10 percent.

- Ireland does not currently place a tax on gambling winnings. Betting establishments are subject to taxes and fees that generate tens of millions of Euros for the government. There have been discussions about taxing winnings but the idea appears to have been rejected in favor of extra taxes on betting businesses.

Irish minister for finance Michael Noonan has been striving to implement an online betting tax since taking up his post over three years ago. Prior to the arrival of Noonan, Dermot Ahern previously held the post. Ahern had also been trying to introduce an online gambling tax, but since 2009. Government estimates suggest that such a tax would generate approximately €25 million a year.

€1.6b Revenue for Operators

At the core of the proposed legislation is a desire to tax foreign gambling operators who are targeting Irish residents without being registered in the country. The remote gambling services provided in Ireland are said to generate revenue of approximately €1.6 billion annually. Again, the proposed tax would be €25 million of that figure. From the annual tax revenue, it is proposed that up to €11 million will be contributed to capital as well as horse racing and greyhound racing.

Changes to 1931 Legislation

The Betting (Amendment) Bill 2013 is at last set to be implemented, providing a long awaited update to legislation that had dated back to 1931 in some aspects. Noonan had been so eager to introduce change that he made the alteration of the existing legislation his first act as minister of finance.

Rural Benefits

An important factor in promoting the change to Irish politicians has been Noonan’s promise of funding for the bloodstock industry to boost the rural economy. But Horse Racing Ireland is a more specific beneficiary, with the organisation set to receive €5 million in funding to invest in race courses.

Paddy Power Welcomes Tax

From the gambling operators present in Ireland, Paddy Power has openly welcomed the change in legislation. In fact, Paddy Power stated that the company had collaborated with the government. Paddy Power is eager for all Irish-based operators to be competing in a fair market with foreign operators.

See also

Industry Future Revenue Billions Annually

m-platba

Ultimate Gaming Pulls Plug on NJ Online Gambling

Vegas Casino Online: $17m in Winnings Since 2002

Australia Looks Into Tax for Online Operators

A long-debated tax on international online-gambling services who offer their services to Irish punters is set to become law, according to a statement from Ireland’s finance minister, Michael Noonan.

The tax change, in which remote (online) operators are required to pay 1% of their total revenue derived from Irish-facing online gambling sites, will go into effect later this year. The change has been debated sine 2011 in various forms, and was finally codified with the introduction and eventual passage of Ireland’s Betting (Amendment) Bill 2013.

The change to the applicable tax code for online-gambling providers extends a similar tax that has long existed in physical Irish betting shops, following the trend over the last 15 years of most sports wagers now being placed online. Irish market leader Paddy Power has disclosed that roughly three quarters of all its Ireland-derived revenue now occurs via online bets. The change, according to Paddy’s CFO, Cormac McCarthy, would have resulted in an eight million Euro tax levy for Paddy Power in 2014, and will likely result in a similar tax bill this year as well.

Paddy Power’s McCarthy made the comments in a brief press meeting following the announcement by finance minister Noonan of the bill’s imminent signing, as reported by Reuters and other sources.

The Irish online gambling bill mirrors in some aspects a controversial point-of-consumption tax that was implemented last year in Great Britain, and which remains under legal challenge in that country by a major Gibraltar trade association whose members are targeted by the online levy included in the UK’s Gambling (Licensing and Advertising) Act 2014.

Like the Irish measure, the UK act implements a tax on online services, whether or not the company or companies in question maintain a physical business presence in the country — either Ireland or the UK — where the punters and their betting action are physically located.

Several dozen prominent UK gambling firms have relocated to Gibraltar over the past decade to take advantage of the tax-free “online” loophole, as offered by Gibraltar. Those firms continue to battle the new UK tax regime under the auspices of the Gibraltar Betting and Gaming Association (GBGA), which counts roughly two dozen of the former British firms as members.

By comparison, Paddy Power remains tied to and proud of its Irish heritage, and remains incorporated in Dublin. However, like its industry competition, Paddy Power has also derived some measure of its recent corporate profits from the growing tax-free loophole, which the Irish tax-code modifications plan to slam shut.

The official signing of Ireland’s Betting (Amendment) Bill 2013 will take place in the coming days or weeks. The new law will then implement a brief grace period allowing all firms offering online services to Irish punters to obtain licensing from Ireland.

Ireland’s change continues to highlight a growing point of contention between online-gambling service providers and those countries who chose to license them: Whether taxes on the service should be based on point of consumption (where the bettors live) or country of incorporation. EU outposts such as Gibraltar and Malta have transformed themselves into tax havens catering to the online gambling industry, and their national revenue streams increasingly depend on the licensing regimes associated with that activity.

The shift by many other countries to point-of-consumption taxation frameworks directly threatens the tax-haven status of Gibraltar, Malta, and other remote licensing jurisdictions. Maltese government regulators in particular have previously decried both the Irish and UK tax implementations as an alleged violation of EU “free trade of services” agreements.

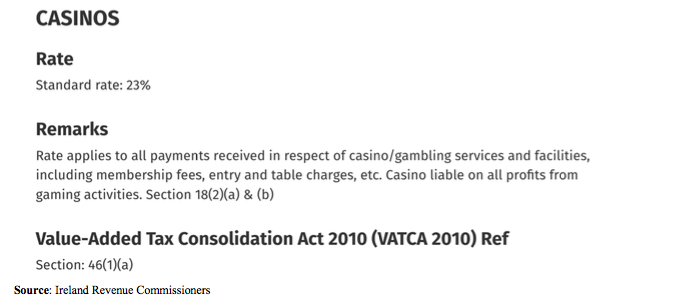

Ireland Online Gambling Tax Rates